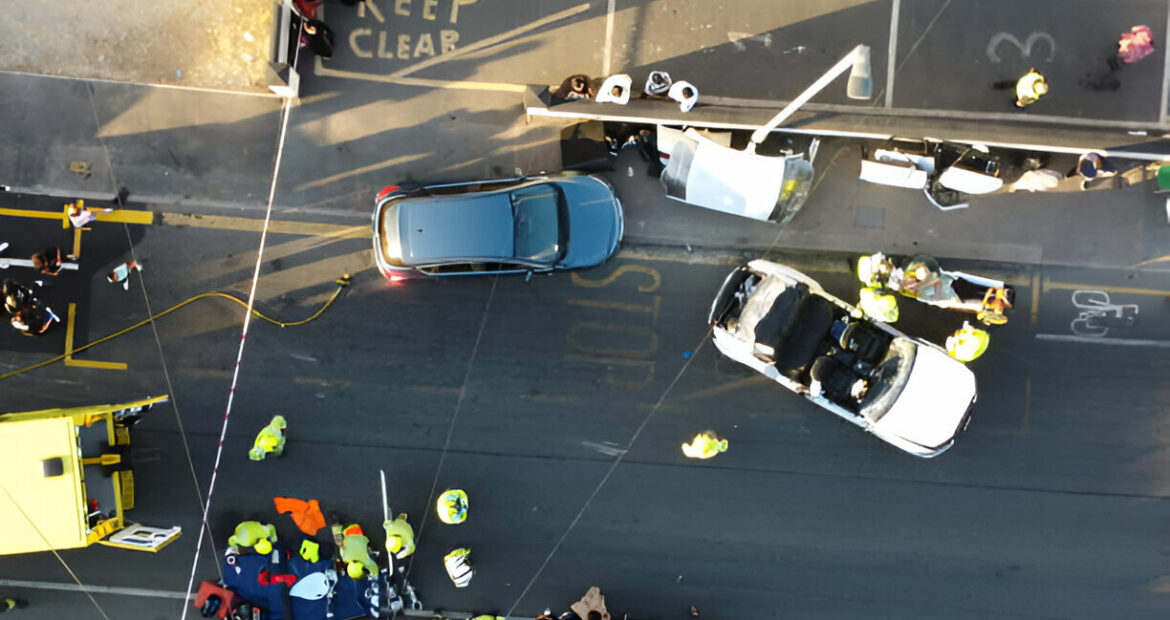

Understanding Hit-and-Run Accidents

A hit-and-run accident occurs when a driver involved in a collision fails to stop, offer assistance, or exchange details as required by law. This type of incident may involve another vehicle, property, or a pedestrian. Under the Road Traffic Act 1988, drivers are legally required to stop and provide their details if an accident results in personal injury. Failing to do so constitutes a criminal offence.

Claims Related to Hit-and-Run Accidents

Hit-and-run accidents are unfortunately common, and failing to exchange details or report the incident to the police is a legal offence. Victims may be left injured on the road without access to emergency assistance. However, there are avenues available for seeking compensation.

Claiming Against an Uninsured Driver

Victims of road traffic accidents caused by uninsured drivers can still seek compensation through the Motor Insurers’ Bureau (MIB), an independent organisation funded by motor insurers. The MIB steps in to provide compensation for claims involving uninsured drivers. However, certain conditions must be met:

-

The accident must be reported to the police.

-

The MIB must be informed if legal proceedings are initiated.

-

A judgment must be obtained against the uninsured driver before the MIB will process the claim.

Claims involving hit-and-run incidents are handled under a separate scheme with specific procedures, while uninsured driver claims follow standard civil protocols.

Tracing an Uninsured Driver

Some drivers flee the scene of an accident because they are uninsured or driving stolen vehicles. If the vehicle cannot be traced, the responsible party may avoid legal consequences. However, even without a registration number, a claim can still be made through the Motor Insurers’ Bureau (MIB) for injuries and other losses. MIB Untraced Driver claims follow strict legal guidelines, making them more complex than standard personal injury claims.

The Role of the Motor Insurers’ Bureau (MIB)

The Motor Insurers’ Bureau (MIB) compensates victims of hit-and-run accidents using funds collected through a levy on motor insurance premiums. If the at-fault driver cannot be identified or does not have valid insurance, the MIB can step in to process the claim. A personal injury solicitor can assist in navigating the process and help ensure that victims receive the compensation they are entitled to.

Consequences for Uninsured Drivers

Driving without insurance is a serious offence and carries severe penalties, including:

-

Six penalty points on the driver’s licence

-

A fixed penalty fine of £300

-

Possible court prosecution, which may lead to harsher penalties such as disqualification from driving

-

Seizure of the vehicle by the police

-

Full financial liability for any injuries or damages caused in an accident

Vehicle Repairs After a Hit-and-Run

If your vehicle is damaged by an uninsured driver, you may be eligible for compensation through the MIB. To file a claim, you must provide supporting evidence such as:

- Witness statements

- CCTV footage

- Police reports

- A vehicle repair invoice

If your vehicle is declared a total loss, you may need to negotiate with the MIB regarding salvage value. Proper documentation is crucial for a successful claim.

Does Insurance Cover a Hit-and-Run Accidents?

Several types of insurance can help cover damages and injuries resulting from a hit-and-run:

- Uninsured Vehicle Coverage: Protects against damages if the at-fault driver is unidentified or uninsured.

- Accident Coverage: Covers repair costs regardless of fault but may require an excess payment.

- Personal Injury Protection: Covers medical expenses for the driver and passengers, separate from fault determination.

- Medical Treatment Costs: Offers additional support for medical bills, complementing PIP or where PIP is not available.

Contact your insurance provider as soon as possible. Submit all necessary documentation, including police reports, photos, and witness statements.

Impact of a Hit-and-Run on Insurance Premiums

Being involved in a hit-and-run accident can impact your insurance premiums. If the at-fault driver is untraced, your insurer may categorize you as a higher risk, leading to increased rates upon policy renewal.

- No-Fault Accident Claim: Filing a claim under comprehensive or uninsured motorist coverage may still result in higher premiums

- No-Claims Bonus:If the responsible driver isn’t identified, your no-claims bonus could be impacted.

- Premium Increase: Expect a possible increase in your insurance premium at the next renewal.

Penalties for Hit-and-Run Violations

Committing a hit-and-run offense can result in serious legal consequences, including:

-

Six penalty points on your driver’s license

-

Unlimited fines, depending on the severity of the accident

-

Up to six months in prison for serious cases involving injury or significant property damage

Understanding the legal and financial implications of hit-and-run accidents can help individuals navigate the aftermath more effectively and pursue appropriate compensation.